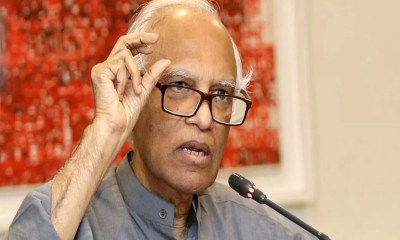

Bankers discovered that big businesses previously laundered a lot of money, according to Selim R. F. Hussain, Managing Director (MD) and Chief Executive Officer (CEO) of Brac Bank Ltd. and Chairman of the Association of Bankers, Bangladesh (ABB).

However, according to him, money laundering through trade has not completely stopped but has significantly decreased.

While addressing a rare ABB press conference on "Banking Sector Outlook 2023," which was held on Monday at the Brac Bank headquarters in the Gulshan area of capital Selim also said that the central bank`s actions to promote falling import costs, healthy export receipts, and remittance inflows have caused the foreign currency burden on banks to progressively ease.

In response to a question about Bangladesh`s financial standing, he said, “In the past eight months, banks were in a situation that often went through payment delay, deferred payment, and foreign currency crunch in case of new L/C opening.

"The situation has become comfortable now as more advancements are likely to come from development partners like the Asian Development Bank, World Bank, International Monetary Fund, Asian Infrastructure Improvement Bank, Japan, South Korea, and others.”

He claimed that for the first time ever, a depreciation of the local currency by 25% has significantly increased macroeconomic stress by reducing the supply of foreign currency and escalating inflationary pressure.

He stated that "big businesses laundered money abroad through trade" in reference to money laundering through banking systems.

“The big trading officials have presented us with the costs of capital machinery and other commodities, and requested for our approval. We were left with no other option because the National Board of Revenue (NBR) did not provide a referral price or a universal price code. In the case of exports, there were under invoices in a similar way,” he furthered.

To be cautious in this regard, however, the bankers have adopted Bangladesh Bank`s directive and used digital data sources available online to examine pricing before opening L/Cs, the Brac Bank CEO addded.

Answering questions from journalists regarding non-performing loans (NPL), Selim R F Hussain said, “NPL has been the big problem of banks in our country. Only banks and the central bank alone couldn’t resolve it. It needs to be resolved by coordinated policy interventions involving other actors too.”

Mashrur Arefin, MD and CEO of The City Bank Ltd., added to this in the following way, "Monthly import spending reduced from $7.0 billion to $4.5 billion per month, opening the path to save $2.5 billion. A decrease in the import of raw materials for the textile and apparel industry which will save $1.0 billion out of a total cost of $2.5 billion. The remaining $1.5 billion is a matter of concern that we had to pay because imports were over- or under-billed. The case exists with relation to capital flight or money laundering, and it needs to be thoroughly evaluated.

Among others, ABB Vice Chairmen and MD and CEO of Dutch Bangla Bank Ltd, Abul Kashem Md. Shirin, MD and CEO of First Security Islami Bank Ltd, Syed Waseque Md. Ali, ABB Treasurer and MD and CEO of Midland Bank Ltd, Md. Ahsan-uz Zaman spoke at the press conference.

ABB is a forum for leading bankers that focuses on various modern concerns and, if needed, offers recommendations and comments to banks and regulatory authorities.

-20251206083331.jpeg)

-(25)-20251122062715-20251202031751.jpeg)

-(25)-20251122062715-20251204041734.jpeg)