Several countries across Asia and Europe are under economic pressure to repay Chinese debt. In terms of International Finance, China's policy falls under the category of 'debt-trap diplomacy '.

After China took over Hambantota seaport in Sri Lanka, the Gwadar port in Pakistan and control over Laos' mineral resources, as well as dominance over many African markets, allegations arose of China being a ‘loan shark.’.

Since 2016, China has pumped millions of dollars into the Bangladesh economy, arising skepticism and fear amid policymakers that Bangladesh could soon fall into the Chinese debt trap. So the question persists, is Bangladesh falling under the Chinese debt trap?

It all began with easy and friendly loans

China started to hand out friendly loans to Bangladesh to bolster economic ties between the two nations. When Bangladesh was denied debt from the World Bank over allegations of corruption back in 2010, and also the Asian Development Bank was not looking forward to support Bangladesh financially, China lend its hand.

The financial support that the Bangladesh government received in a time of dire crisis, led to the increased bond between Bangladesh and China.

However, later the authorities decided to construct the Padma Bridge with domestic funds. But, Bangladesh inked an agreement to receive technical assistance from China for the Padma Bridge. It may be noted here, that except the Rooppur Nuclear Power Plant, China has direct or indirect influence in all mega-infrastructure development projects in Bangladesh.

In simple terms, China dominates almost all the roads, bridges, ports, terminals , and power projects in Bangladesh.

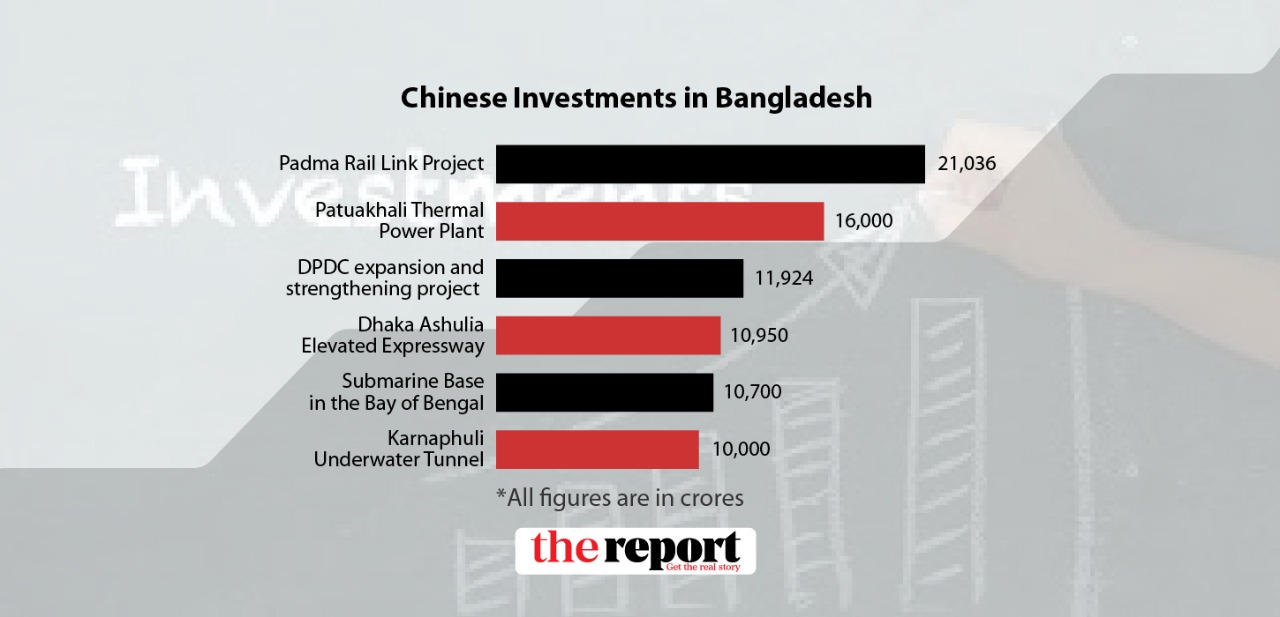

Bangladeshi development projects which have financial Chinese assistance

In addition to China’s assistance in the construction of the ambitious Payra Port, China has out BDT 10 thousand crores for the construction of a tunnel at the end of the Karnaphuli river. The tunnel’s length is 3.5 kilometers.

The China Railway Engineering Cooperation, a state owned holding company of China os working on the rail link to the Padma Multipurpose Bridge, for which the Exim Bank of China has injected BDT 21.36 crores.

It may be noted that Exim Bank also provided financial support for the ports which China took over in Sri Lanka and Laos, as the countries were unable to repay Chinese debt.

China has also funded more than BDT 16 thousand in the coal-fired thermal power plant to be built in Patuakhali.

More than BDT 11 crores have been invested by China to expand and strengthen the power system network in the Bangladesh capital Dhaka under the DPDC project area.

The Dhaka-Ashulia Elevated Expressway is also being constructed with Chinese funds worth BDT 10,950.

Recently, a Chinese company has inked an agreement to build a submarine base in the Bay of Bengal at a cost of Tk 10,600 crore.

The Tannery Estate project is also being run under a Chinese contract.

China started pumping finance into Bangladesh in the form of loans or grants since 1974, according to data from the Economic Relations Department (ERD) of the Ministry of Finance. Since then, China has provided loans, grants, or financial assistance of about 320.98 billion to Bangladesh.

Is Bangladesh at risk?

According to the World Bank and the International Monetary Fund (IMF), a country is at risk if it has foreign debt of more than 40 percent of its GDP. Bangladesh 's foreign debt is only 14 percent, of which China's share is 6.5 percent.

Of the countries or institutions to which Bangladesh is still indebted are as follows: 36 percent are from the World Bank, 24.5 percent from the Asian Development Bank (ADB), 18 percent from JICA, 8.52 percent from China, 6.17 percent from Russia, and 1.3 per cent from India.

Therefore, Bangladesh is far from the danger of falling into the Chinese debt trap. Besides, Bangladesh has a good record of loan repayment.

In this regard, Foreign Minister Dr. AK Abdul Momen said that “the propaganda” that Bangladesh is going to fall into the debt trap of China is completely fabricated. If the amount of foreign debt is more than 40 percent, it is a cause of concern, whereas Bangladesh's foreign debt is only 14 percent, of which China's share is approximately 6 percent, which is actually very low.

Prime Minister's intervention

The conversion of Akhaura-Sylhet meter gauge line into dual-gauge and construction of Joydevpur-Ishwardi mixed gauge double line was estimated at BDT 30,325 crore. In 2020, the Prime Minister's Office (PMO) announced plans to revise the project. The PMO instructed to eliminate unecessary cost.

China does not allow open tenders when it comes to government-to-government (G2G) lending. The companies (contractors) hired by the Chinese government arbitrarily increase the price of everything from the necessary equipment to the various parts of the project.

Many times, these companies do not take this extra price but they fix the cost of 'Feasibility Study' according to their own terms and benefits.

What led to worsening debt situations in other countries?

Under its promising Belt and Road Initiative (BRI) China is investing in about 75 countries around the world.

According to policy analysts, as a means of increasing influence and prestige, China would reap maximum benefits by investing in Bangladesh.

Sri Lanka has been forced to hand over its 99-year-old port of Hambantota on its south coast to China after failing to repay a loan. Sri Lanka's foreign debt is 400 percent of its GDP.

The situation is similar in Laos and Nigeria. The European country of Montenegro is in a similar crisis.

Mujahidul Haque Sourav, a researcher at the Belt and Road Initiative (BRI), said that the future of the world could be in crisis due to the shifts in international politics.

However, Bangladesh is not spending extra money on development projects unreasonably. The Prime Minister's Office has asked for a re-evaluation of the cost of the two railway projects.

-20260226080139.webp)

-20260225072312.webp)

-20260219054530.webp)

-20260224075258.webp)

-20260221022827.webp)