The Jatiya Sangsad has passed the Finance Bill 2022 with some changes, including in the offshore tax amnesty, and thus paving the way for passing of the national budget for FY23 on Thursday.

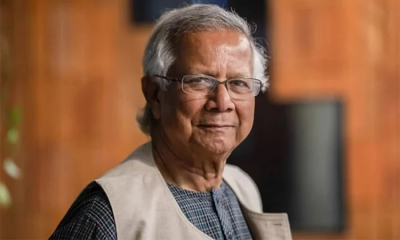

Finance Minister AHM Mustafa Kamal moved the bill in the Jatiya Sangsad this evening in presence of Leader of the House and Prime Minister Sheikh Hasina and it was later passed by voice vote on Wednesday, reports BSS.

In his winding up speech, the Finance Minister said that Bangladesh grabbed the first position in the world gaining 188 percent growth from 2009 to 2019 leaving China in the 2nd slot with a growth of 177 percent.

Citing an estimation of the Asian Development Bank, Kamal said that the GDP growth rate of Bangladesh would be the 2nd highest in Asia in the outgoing fiscal (FY22) year and also in the next fiscal year (FY23).

He also expressed gratitude towards Prime Minister Sheikh Hasina for her strong dynamic leadership.

Among the accepted 17 amendment proposals in the Finance Bill 2022, the government kept one of three offshore amnesty tax facilities, allowing disclosure of only repatriated assets for a 7 percent tax while removing any option of keeping wealth abroad by paying penalties.

Meanwhile, two provisions of the much discussed offshore tax amnesty facility were not accepted.

The provision of penalty for individuals who conceal information about offshore assets in the Amended Finance Bill-22 was passed in Parliament.

While placing the budget for FY23, Finance Minister AHM Mustafa Kamal said to avail the offshore tax facility, Bangladeshis can repatriate any cash, bank deposits, bank notes, bank accounts, convertible securities and financial instruments by paying a 7% tax.

The tax amnesty will allow owners of such assets and cash to become tax compliant and avoid fines, penalties and criminal charges.

The latest bill said, "The provisions of this section shall not apply to cases where any proceeding has been drawn on account of tax evasion or criminal activities under any provision of this Ordinance or any other law by thirtieth June, 2022."

Under the proposed changes, if the offshore assets of an individual taxpayer are not disclosed and are later discovered, the government might slap a fine tantamount to the value of the concealed assets.

In such a case, any local assets of the taxpayer concerned might also be confiscated and auctioned by the government.

The finance minister had earlier proposed allowing Bangladeshi citizens to legalise any movable assets, including cash, bank accounts, securities and financial instruments without repatriation to Bangladesh by paying a 10% tax, but this proposal was not included in the amended Finance Bill.

The budget proposal also said undisclosed asset holders would be allowed to show any of their immovable assets outside Bangladesh in tax returns by paying a 15% tax. This proposal was also not included in the final budget for FY23.

The Amended Finance Bill 2022 relaxed the total cash transactions a company can do in a year from the proposed Taka 12 lakh to Taka 36 lakh to get a 2.5% corporate tax cut facility. Of this Tk36 lakh, the government also added a Tk5 lakh limit on a single transaction.

At the same time, all the transactions above Taka 36 lakh have to be done through banking channels, which was termed traceable channels in the proposed budget.

This will be applicable for listed companies, non-listed companies and OPC (one person companies).

If the companies fail to comply with the aforementioned cash transaction limitations, then the tax rate for listed companies will be 22.5%, non-listed 30% and OPC 25%.

Publicly listed companies will also have to offload more than 10% of their shares as proposed in the budget.

In the final budget, companies and firms no longer have to provide proof of submission of tax returns, but can instead furnish a system generated certificate containing name and the Taxpayer's Identification Number (TIN) in the year they are incorporated, registered or formed and the following year. But proof of tax return will become mandatory from afterwards.

In the proposed budget, the deputy commissioner of taxes could institute a fine not exceeding Taka 10 lakh for any non-compliance of any tax rule, but the final budget says no penalty can be imposed without giving a reasonable opportunity to any offender to be heard.

Earlier, some opposition bench members proposed publishing the Finance Bill 2022 for eliciting public opinions.

Later, the proposals for publishing the bill for eliciting public opinions and other amendments were rejected by voice vote.

The House accepted some 17 amendments to the Finance Bill, 2021 from ruling party MPs including Abu Sayed Al Mahmud Swapan, Ashim Kumar Ukil from the amendment list 2(Ka) and 2 (Kha).

The amendments proposed by the opposition members were rejected by voice vote.

Responding to the parliament members amendment proposals, the Finance Minister said had there been normal situation in the economic arena of the country, then many of the amendment proposals could have been considered.

But, under the present circumstances, the rest of amendment proposals other than the 17 adopted proposals, could not be accepted, Kamal added.

Earlier on June 9, the Finance Minister placed a Taka 6,78,064 crore proposed budget for FY23 at Jatiya Sangsad considering recovery from the pandemic, the Russia-Ukraine war and also keeping ahead six key challenges with containing inflation as the major one.

"Certainly, we shall be able to transform Bangladesh into a hunger and poverty-free society by achieving SDG in 2030, a higher-middle income country by 2031, a knowledge-based, happy and prosperous developed country by 2041 and a secured delta by 2100," said Kamal while placing his 208-page budget speech for FY23 lasting over two hours from 3:05 pm.

Considering the lagged effects of the COVID-19 and the protracted crisis arising from the Russia-Ukraine conflict, Kamal set up a GDP growth target of 7.5 percent in the next fiscal year while to contain inflation at 5.6 percent.

The title of the budget for the next fiscal year is "Return to the Path of Development; Leaving the COVID-19 Behind".

-20260219110716.webp)

-20260219054530.webp)