The National Pension Authority (NPA) has initiated programmes to raise awareness and attractive offers to increase participation of people from different sectors in the universal pension scheme (UPS).

To this effect, the NPA works on publicity of benefits, easy process of enrollment and return of benefits among expatriates, private sector job holders including private banks employees.

Talking with UNB Md. Golam Mustafa, member (as government representative) of NPA and additional secretary of the finance division, said regarding poor response of people in the scheme, that different developed countries like Japan and Korea introduced universal pension’s scheme in the 1960. After so many years, universal pension has reached a stage in those countries.

“We won`t need that much time. We have seen the experience of those countries about universal pensions,” he pointed out.

They said, “In the beginning they also faced various problems like us. I believe we will succeed in universal pension much earlier than those countries.”

He said that 19,158 people have contributed to UPS in about 6 months and around Tk28. 67 crore deposited in the fund so far.

Golam Mustafa said that the NPA is very much conscious of protecting people`s deposits. The government cannot take any loan from this fund.

Rather, “We invest in treasury bills and bonds, so that the income in the investment in bills and bonds is guaranteed. As a result there will be no apprehension among people about this fund.”

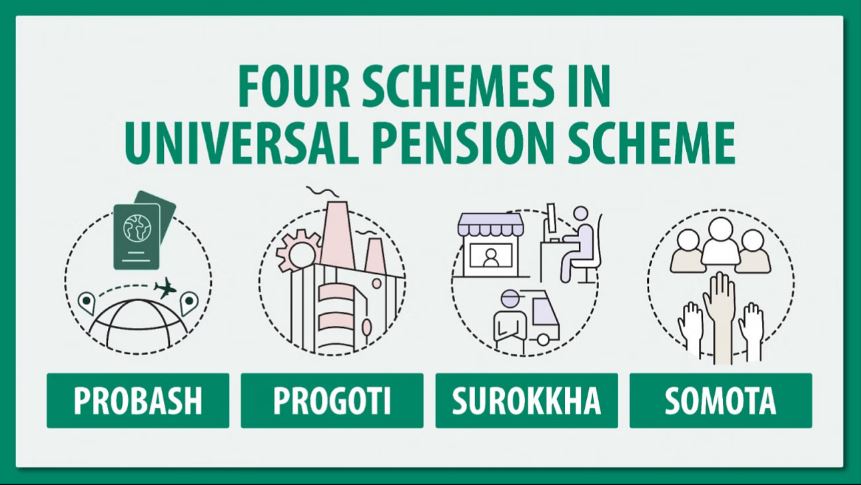

For the first time in its history, Bangladesh on August 17, 2023 entered the era of a much-hyped uniform pension scheme. The initiative is meant for the entire population of the country aged above 18, who will start enjoying lifetime pension facilities upon turning 60.

Economists say that a large portion of the population of the country is still not aware of this financial protection. This is why the NPA wants to make it easier for expatriates to participate. Besides, attractive initiatives are being taken to promote UPS among the people of the country.

Bangladesh Bank (BB) has instructed the managing directors (MDs) and Chief Executive Officer (CEOs) of scheduled banks to encourage the employees of private banks to join the pension scheme.

As part of new initiatives for the implementation of the national pension scheme, the Banking Regulations and Policy Department of BB gave this instruction on February 8. A letter in this regard has been sent to the MDs of all banks for execution of the initiative.

According to the directive, the government wants to include people from all walks of life in a sustainable and well-organized social security circle. To fulfill this objective of the government, the officers and employees of banks other than state-owned commercial banks and specialized banks can participate in the universal pension scheme.

Therefore, Bangladesh Bank has given instructions that MDs of private banks should take necessary measures to motivate them.

Besides, the NPA has recommended withdrawal of tax and excise duty at source of bank account in public pension scheme. Recently, a letter regarding this has been sent from the Ministry of Finance to the National Board of Revenue (NBR).

The letter said that on October 31, 2023 a notification was issued to provide tax concessions on investment in pension scheme contributions and tax exemption on pension income.

At this stage it is necessary to waive tax and excise duty at source in bank accounts of public pension schemes managed by the NPA in state-owned and commercial banks. Currently excise duty is deducted as per bank account status irrespective of individual, company and other funds.

Economist Dr ABM Mirza Azizul Islam told UNB that due to lack of trust among the people and lack of institutional good governance are blamed for this poor response in the pension scheme.

He said people are still not aware of where the pension scheme money will be invested, how they will profit or incur losses.

Dr Ahsan H Mansur, Executive Director of PRI (Policy Research Institute) said that from the experience of different countries in the world, people`s confidence in such schemes increases with time.

“They also have good institutional governance that is lacking here. So only time will tell what will happen to this scheme in the coming days,” he pointed out.

-20260304091720.webp)

-20260303080739.webp)

-20260225072312.webp)

-20260228064648.jpg)