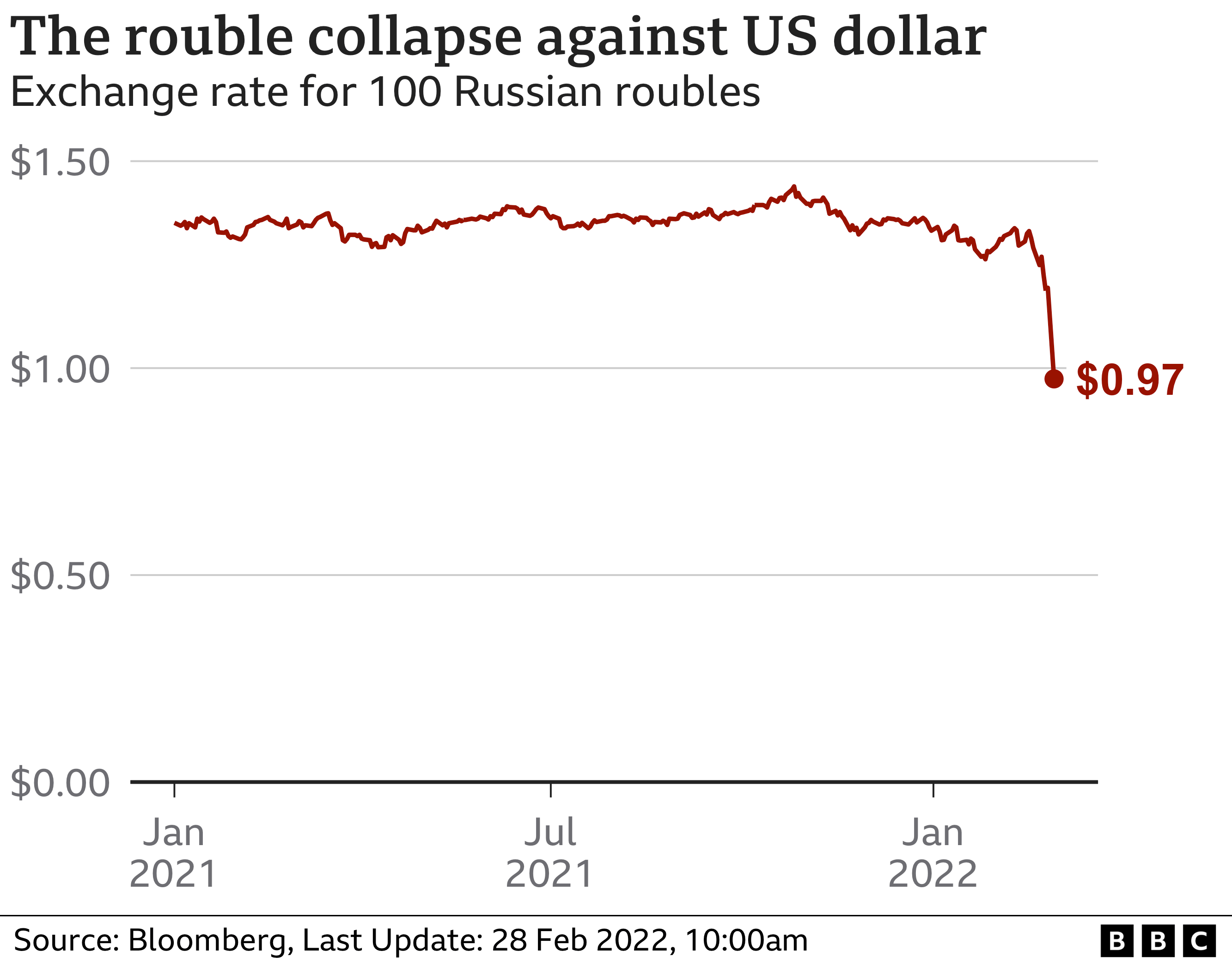

Russia has more than doubled its interest rate to 20% in a bid to halt a slump in the value of its currency, reports BBC citing Bloomberg.

The Bank of Russia raised the rate from 9.5% after the rouble sank 30% after new Western sanctions. The currency then eased back to stand 20% down.

The collapse in value erodes the currency's buying power and could wipe out the savings of ordinary Russians.

Amid pictures at the weekend of queues at cash machines, Russia said it had the resources to ride out sanctions.

Ahead of an emergency meeting between President Vladimir Putin and his economic advisers on Monday, Kremlin spokesman Dmitry Peskov said: "These are heavy sanctions, they're problematic, but Russia has the necessary potential to compensate the damage from these sanctions." He said Russia would respond with its own sanctions.

At the weekend, Russia's central bank issued an appeal for calm amid fears that new financial sanctions could spark a run on its banks. It said it had the "the necessary resources and tools to maintain financial stability."

Videos on social media on Sunday appeared to show long queues forming at cash machines and money exchanges in Moscow, with people worried that their bank cards may stop working or that limits will be placed on the amount of cash they can withdraw.

Chris Weafer, chief executive at consultancy firm Micro-Advisory and based in Moscow, said on Monday he was seeing some queues in food stores.

"You are beginning to see a little bit of queuing in some grocery stores, particularly people buying some goods that they think might come into short supply due to trade restrictions or maybe will be subject to big price increases because of the rouble devaluation.

"This set of sanctions is hitting ordinary Russians to an extent that previous sanctions have not and people are now becoming aware of that.

"People are a lot more fearful. There is already talk about some companies having to either go on reduced working hours, or even suspend production because they're not able to access maybe key parts from the West due to sanctions or due to trade limitations, so there's a great deal of concern on the street."

Moscow resident Anastasia told Reuters that she expected her economic situation to get worse. "It's inevitable in these circumstances," she added. Whilst another Moscow resident Sergey said he was already seeing an impact. "Prices are rising, of course, savings are shrinking and stocks are falling."

The UK, along with the US and EU, have already cut off Russia's banks from financial markets in the West, prohibiting dealings with the central bank, state-owned investment funds and the finance ministry.

Chancellor Rishi Sunak said the measures demonstrated the UK's "determination to apply severe economic sanctions in response to Russia's invasion of Ukraine".

Russia has about $630bn (£470bn) in reserves - a stockpile of savings - built up from soaring oil and gas prices.

But because a lot of this money is stored in foreign currencies like the dollar, the euro and sterling as well as gold, a Western ban on dealing with Russia's central bank restricts Moscow from access to the cash.

Last week, Russia's central bank was forced to increase the amount of money it supplies to ATMs after demand for cash reached the highest level since March 2020.

On Monday, the central bank said it had ordered brokers to suspend the execution of all orders by foreign legal entities and individuals to sell Russian investments.

-20260226080139.webp)

-20260223082704.webp)

-20260225072312.webp)

-20260219054530.webp)

-20260224075258.webp)

-20260221022827.webp)