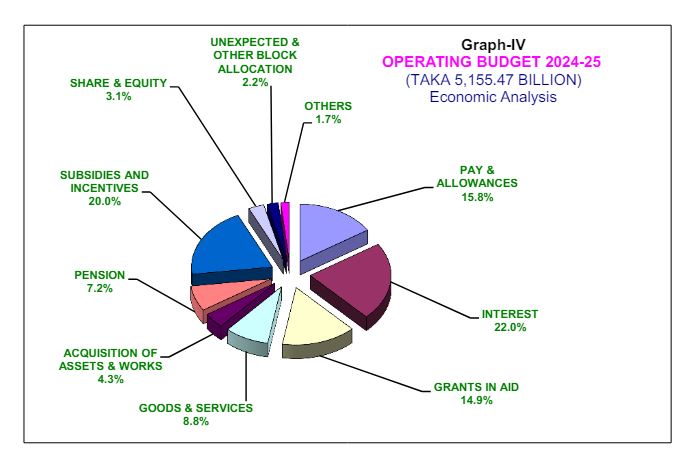

Government employees will receive a significant portion of the budget allocation, with 24% set aside for their benefits. According to the proposed budget, for every 100 Tk of tax, government employees will receive 15.80 Tk as salary and wages, while retired employees will be entitled to a pension of 7.20 Tk. This allocation for salaries and pensions amounts to a total expenditure of 24 Tk from the government`s budget.

Additionally, starting from the Prime Minister and extending to all ministers and officials, salaries and allowances for government personnel, including those in various agencies like the IGP, will be disbursed.

Interest payments will be the single largest expenditure in this budget. For every 100 Tk of tax collected, 22 Tk will be spent on interest payments. This includes payments for loans acquired from various development projects and international donors.

Furthermore, a portion of the budget will be allocated to cover expenses for hospitals and other government service providers, amounting to 8.80 Tk.

The breakdown of how 100 Tk of tax is allocated is as follows:

Salaries and Allowances: 15.80 Tk

Interest Payments: 22.0 Tk

Grants and Aid: 14.90 Tk

Goods and Services: 8.80 Tk

Asset Acquisition: 4.30 Tk

Pension: 7.20 Tk

Subsidies and Incentives: 20 Tk

Shares and Equity: 3.10 Tk

Contingent Expenses and Others: 2.20 Tk

Miscellaneous Expenditure: 1.70 Tk

-20260305071113.webp)

-20260304091720.webp)

-20260303080739.webp)

-20260228064648.jpg)