The caretaker government has approved major amendments to the much-debated Revenue Policy and Revenue Administration Ordinance 2025, ensuring that only qualified and experienced officials will lead the restructured revenue sector.

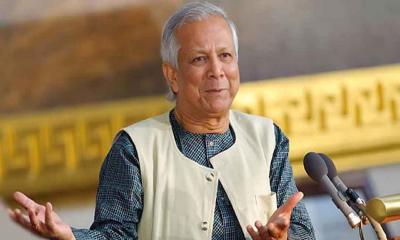

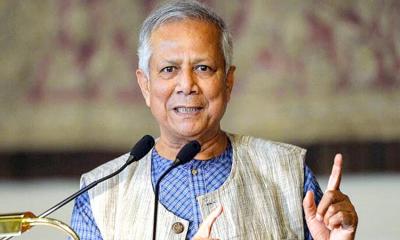

The amendments—11 in total—were passed on Thursday at a meeting of the Advisory Council chaired by Chief Adviser Professor Muhammad Yunus.

The revised ordinance, now titled the Revenue Policy and Revenue Administration (Amendment) Ordinance 2025, was formally approved during the session held at the Chief Adviser’s Office.

Following the meeting, Press Secretary Shafiqul Alam briefed reporters at the Foreign Service Academy, confirming that the most significant change was the requirement that the Secretary of the Revenue Policy Division must be an official with proven experience in macroeconomics, trade policy, planning, or revenue management.

The original ordinance was promulgated on May 12, dissolving the National Board of Revenue (NBR) and creating two separate divisions: the Revenue Policy Division and the Revenue Administration Division. This restructuring sparked strong resistance from NBR officers and staff, who staged protests for over six weeks. The demonstrations escalated in late June, with customs and tax offices halting operations. Business groups eventually mediated to suspend the protests, but disciplinary measures—including suspensions and transfers—remain ongoing within the NBR.

In response to the unrest, a review committee led by Energy Adviser Muhammad Faozul Kabir Khan was formed on June 29 to assess the ordinance and recommend changes. Speaking to Prothom Alo, Adviser Khan explained, “We prioritized three principles in the amendments—competence, experience, and fairness. This ensures that the officials entrusted with responsibilities are not only qualified and skilled but also just and impartial.”

Key Amendments

The Secretary of the Revenue Policy Division must now be an official with relevant expertise in macroeconomics, trade policy, planning, or revenue management, rather than any qualified civil servant.

Positions in tax, VAT, customs policy, double taxation treaties, and international trade agreements will only be filled by officials experienced in revenue collection. Other subsections may be staffed by officials with backgrounds in economics, public administration, research, IT, auditing, or law.

The mandate has been broadened from simply enforcing tax laws to analyzing the impact of revenue policy, tax expenditure, and revenue mobilization.

All key posts, including those in tax, VAT, customs, and field-level revenue administration, will be filled by officials with proven experience in revenue collection rather than being limited to specific civil service cadres.

The Revenue Administration Division will now have explicit authority to draft, amend, and interpret regulations, notifications, rulings, policies, and standing orders.

The focus on revenue automation has been expanded to include both internal integration across divisions and connectivity with other related offices.

Existing NBR staff will be absorbed into the Revenue Administration Division, with transfers to the Revenue Policy Division made through formal regulatory procedures.

The approval of these amendments marks a significant shift in the government’s approach to revenue sector reform, moving away from cadre-based postings to experience-driven appointments, with the aim of ensuring transparency, efficiency, and professional leadership in tax administration and policy-making.