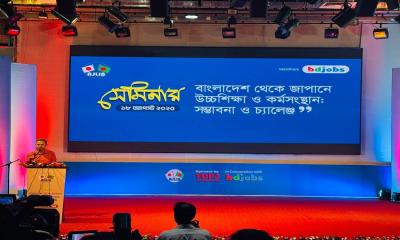

National Board of Revenue (NBR) Chairman Md. Abdur Rahman Khan on Tuesday described the minimum tax law as a “black law,” admitting it contradicts the fundamental principle of taxation.

Speaking as the chief guest at a dialogue titled “Reforms in Corporate Tax and VAT: A Judicial Perspective for NBR” held at a hotel in Gulshan, he said, “There is no doubt that minimum tax is a black law. We must admit it. Tax should be imposed on profit, not on the mere existence of business. But when we introduce minimum tax, it creates distortions. The problem is, if we remove it, revenue collection falls. Once we stabilize the system, we will be able to reform it properly. This year we have tried to create a more business-friendly environment, because without easing business operations, it will be difficult to mobilize revenue.”

The NBR chief admitted that excessive tax exemptions are also holding back the country’s tax-to-GDP ratio. “We have given many exemptions to attract investment. But in practice, many sectors continue to enjoy tax holidays for decades without contributing to revenue,” he said.

He warned of mounting risks from growing debt: “Our tax-to-GDP ratio was 7.4% last year, but it has now fallen to 6.6%. In comparison, Pakistan’s is 12.2%. This is far too low to meet our development needs. Without higher revenue, we will be burdening future generations with debt.”

Khan also stressed the need for automation and digitalization in tax administration. “We want a fully automated NBR. VAT and tax returns should be filed at the press of a button. Manual audit selection has been stopped because it unfairly targeted the same taxpayers repeatedly. Future audits will be based on risk indicators, and until digital systems are in place, manual VAT audits will remain suspended.”

He further noted that expanding the tax net would allow rates of tax and VAT to be reduced, while compliance would make it possible to implement a unified VAT rate and automatic refunds.

A survey presented at the event by the Centre for Policy Dialogue (CPD) found that 82% of businesses consider current tax rates unfair and a major barrier to growth. Another 79% cited lack of accountability among tax officials as a key challenge, while 72% identified corruption in tax administration as the biggest obstacle.

The survey, based on responses from 123 businesses in Dhaka and Chattogram, revealed that 65% of firms often faced disputes with tax officials over arbitrary demands. Regarding VAT, 73.5% said complex laws created major barriers, while others cited unclear policies, limited official support, classification difficulties, and high compliance costs as serious challenges.