Amount of idle money has been mounting up due to shortage of investment. As a result, private banks curtailed the interest rate of the clients. The interest rate at various private banks has been witnessing the bottomward trend in country’s banking history.

Banks, which offered 6-9 per cent interest on 6-month deposit before the pandemic, have cut off the rate by 1.5 per cent. However, investment in the capital market increased as the rate of fixed deposit abridged.

Average interest rate 4.13%

Bangladesh Bank says, the average interest rate has fallen to 4.13 per cent after the month of June which was 5.2 per cent during the same period last year.

Banks have curbed the interest rate on deposit to shrink the fund management expenditure while the inflation rate (point to point) in April was 5.56 per cent.

It means, the clients are not getting interest in line with the reduction of the purchasing power of their deposited money leaving them incurring big loss. Moreover, there are excise duties and other charges.

The credit of general clients is likely to be invested in risky sectors including the capital market, experts fear.

Interest lower than inflation

Not only the deposit interest rate went down, it receded below the inflation rate.

As a result, the clients will be more beneficiary if the money is left idle at home instead of depositing into banks, which is a matter of grave concern, economists think.

They said, such situation will leave the client aloof from banking and it will be ominous.

62000 crore idle money

The banks have a total of taka 62 thousand crore idle money while the surplus fund is almost taka 2 lakh 75 thousand crore leaving the banks struggling to manage expenditure.

The banks are more cautious to bag money than client services as the management has to show profit as the year ends.

Executive Director of non-governmental research institute Policy Research Institute (PRI) and Brac Bank Chairman Dr. Ahsan H Mansur says, the reduction of deposit interest will affect the clients. They are likely to lose capitals if the banks invest the deposit in risky sectors.

The central bank should take moves for the sake of economy, he said.

Investment in capital market hikes

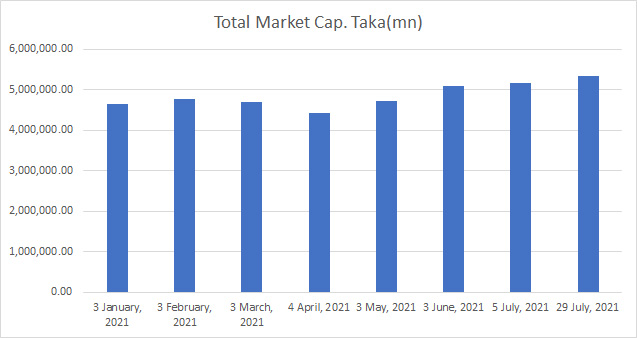

The capital market sprung up big margin in last three months. The Dhaka Stock Exchange (DSE) accounted for 4 lakh 64 thousand 315 crore capital till April 19 this year.

The figure jumped at 5 lakh 35 thousand 185 crore on July 19 after just three months. Some 70 thousand 869 crore taka increased in the capital market in three months.

-20260301064029.webp)

-20260228080513.webp)

-20260224075258.webp)

-20260225072312.webp)