The government has decided to sell assets of Nassa Group under a court order to pay outstanding wages and service benefits to the company’s workers, Labour and Employment Adviser Brigadier General (Retd.) M. Sakhawat Hossain said on Sunday.

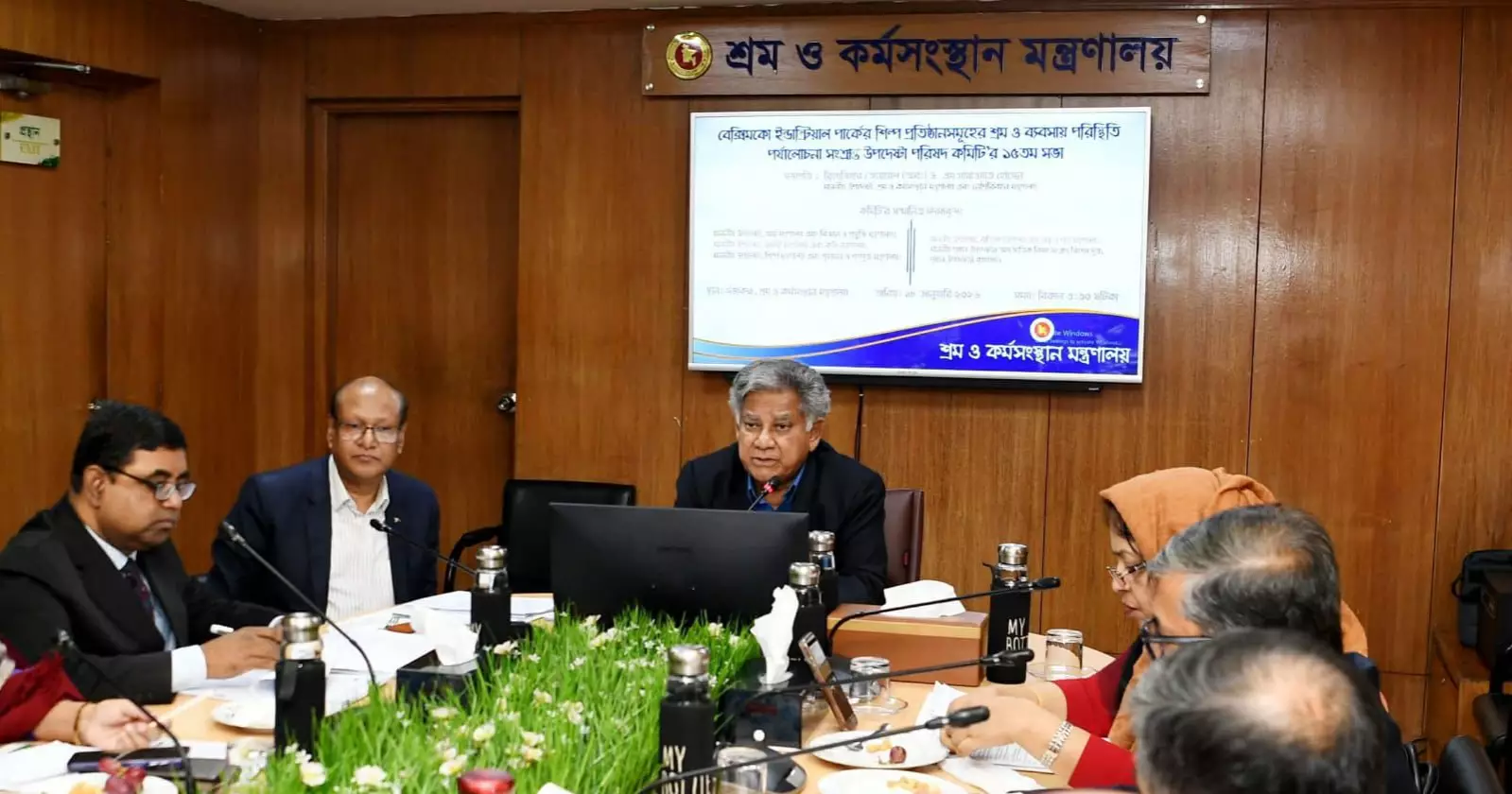

He made the statement while chairing the 15th meeting of the Advisers’ Council Committee, which reviewed the labour and business situation of industrial units at Beximco Industrial Park.

The meeting was held at the Secretariat in Dhaka and attended by top officials, including the Labour Ministry Secretary Dr Md Sanowar Zahan Bhuiyan, a deputy governor of Bangladesh Bank, the Additional Inspector General of Industrial Police, senior officials from several ministries, the court-appointed administrator of Nassa Group, and representatives of various commercial banks.

Adviser Hossain said Tk 76 crore has already been paid to workers through the sale of company shares by the court-appointed administrator.

He added that Nassa Group has also made down payments to eight banks following instructions from Bangladesh Bank.

The remaining payments to 15 banks, along with unpaid worker dues, will be cleared by selling some of the group’s assets through an open and competitive process, in accordance with court directives.

Nassa Group, which employs more than 30,000 workers in its textile and garment units and also has interests in banking and real estate, faced a crisis after its chairman, Nazrul Islam Mazumder, was arrested in October last year in connection with a murder case linked to the July 2024 uprising.

Media reports indicate that the group’s operations have largely stopped since the change of regime in August last year.

Many factories remain closed, and unpaid bank loans are estimated at several thousand crore taka.

Earlier investigations by the Bangladesh Financial Intelligence Unit also alleged that Mazumder was involved in trade-based money laundering worth about Tk 16,000 crore, including Tk 4,717 crore reportedly siphoned from EXIM Bank through 18 shell companies during his tenure as chairman of the bank from 2007 to August 2025.

-20260303080739.webp)

-20260225072312.webp)