In Bangladesh, individual taxpayers are required to submit their income tax returns between July 1 and November 30 each year. As per the National Board of Revenue (NBR) rules, anyone with an annual income exceeding Tk 3.5 lakh is required to pay income tax. For women and citizens over 65 years, the tax-free income limit is set at Tk 4 lakh, while for war-injured freedom fighters, it is Tk 5 lakh.

Additionally, individuals may need to pay income tax if they have prior tax assessments, urban housing, car ownership, memberships in certain professions, businesses, or are participating in tenders or elections. The same applies to registered companies and NGOs.

Those with a Taxpayer Identification Number (TIN) must submit a tax return, regardless of whether they have taxable income. If there is no taxable income, a zero return can be submitted. Failure to do so may result in penalties or legal actions.

Required Documents for Filing

Taxpayers should submit necessary documents, including their eTIN, a photocopy of the National ID (NID), detailed address, and previous year’s return documents. Additional documents may be required if the taxpayer has multiple sources of income. Information about investments, assets, and certificates for tax-free income should also be included.

Steps for Filing Returns Online

1. Obtaining TIN Certificate: All Bangladeshi citizens with a TIN certificate must file a tax return annually. Upon turning 18, obtaining a TIN certificate is mandatory. When applying for a TIN, taxpayers will be allocated a specific tax region. Tax returns can then be submitted at the regional tax office or online.

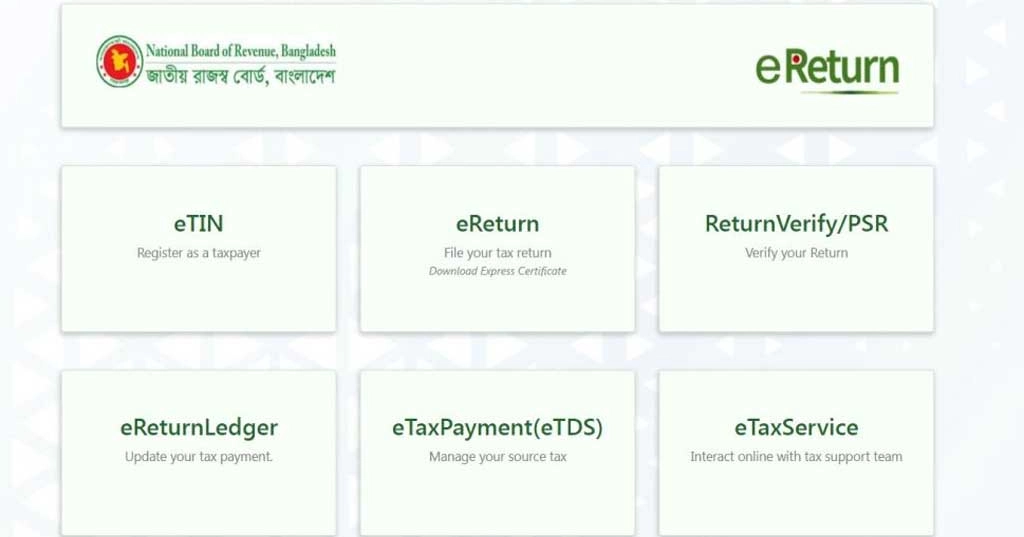

2. Registering for e-Return: To file online, first register on the NBR’s website under the e-Return section. Click `Sign Up,` enter your TIN, NID-registered mobile number, and verify using an OTP. Set a password to access the e-Return system.

3. e-Return Submission Process: Once registered, log in using TIN and password, access the `Return Submission` option, and follow the steps for income details, additional information, asset declaration, expenses, and tax payments.

4. Download Receipt: Upon successful submission, a confirmation message with a reference ID will appear. Download or print the receipt for online or physical submission at the tax office.

Following these steps can help individuals and businesses comply with tax requirements smoothly and avoid penalties.

-20260108103159.webp)

-20260226080139.webp)

-20260225072312.webp)

-20260219054530.webp)

-20260224075258.webp)

-20260221022827.webp)